Craft3 cofounders, Mike Dickerson and John Berdes

Tiffany Turner, owner, Bowline Hotel

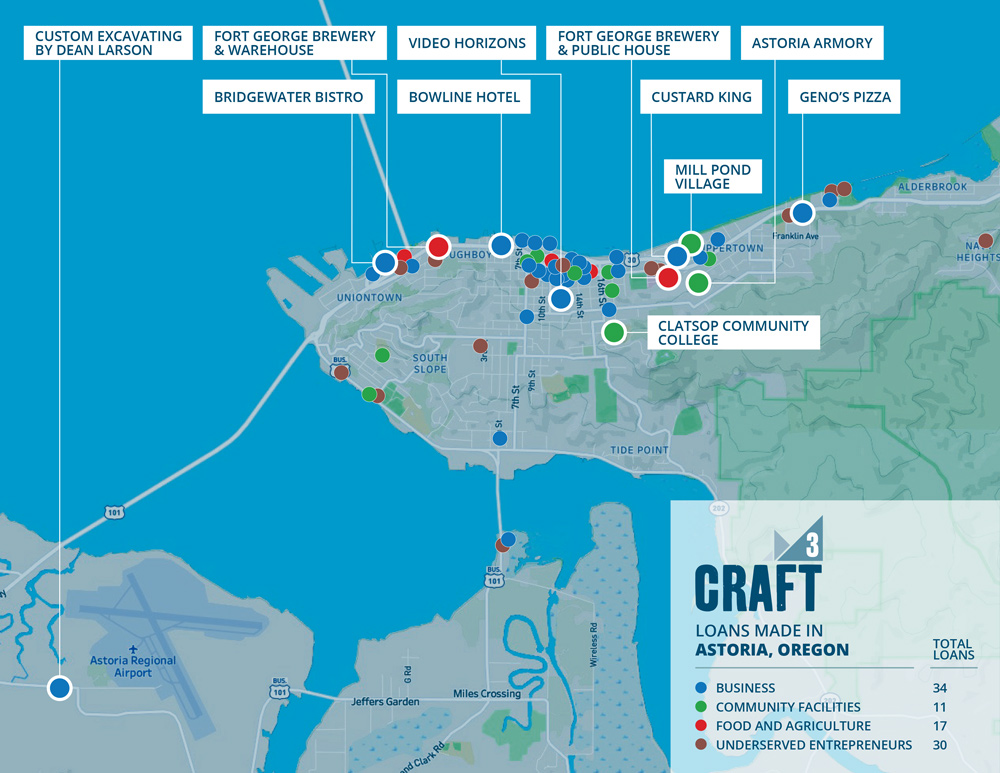

Bowline Hotel

Chris Nemlowill, cofounder, Fort George Brewery

“We want to be one of the best places you can get a job on the West Coast.”

Chris Nemlowill

Cofounder, Fort George Brewery

Fort George Brewery

Ilwaco, WA