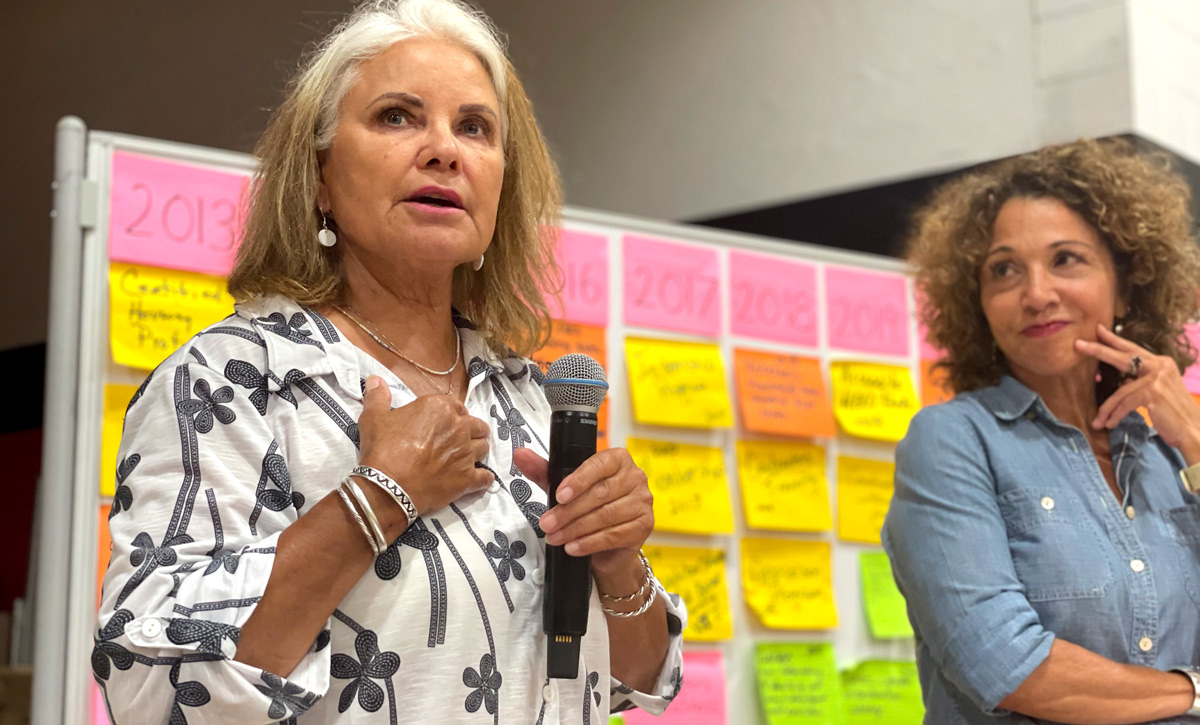

Elsie Meeks (Oglala Lakota), former Northwest Area Foundation board member and founder of the Coalition, speaks at the group’s 10th annual conference alongside Tawney Brunsch (Oglala Sioux), Coalition secretary and executive director of Lakota Funds.

Darrell Zephier (Hunkpati Dakota), a participant in the drum circle at the Coalition’s 10th annual conference.

The Coalition is changing financial systems to make them more fully responsive to Native needs for housing and finance. These changes are long overdue.

Eric Shepherd (Sisseton Wahpeton Sioux), Coalition vice chair and Sisseton Wahpeton Housing Authority’s executive director.

“What we have now is a shared purpose . . . a line of succession and a blueprint. We’re clear that there is strength in our numbers.”

Eric Shepherd (Sisseton Wahpeton Sioux)

Vice Chair, South Dakota Native Homeownership Coalition

Executive Director, Sisseton Wahpeton Housing Authority

Aerial view of Fort Thompson, SD, on the Crow Creek Reservation.

“We’ve set a model that is being replicated. We’ve got other states that are making their own [Native housing] coalitions based on their needs and resources. I’m really proud of our advocacy and the example we’ve set.”

Sharon Vogel

Chair, South Dakota Native Homeownership Coalition

Photo top: Tawney Brunsch (Oglala Sioux), Coalition secretary and executive director of Lakota Funds.