Current HCAP Partners portfolio company, Arosa, a provider of integrated care management and caregiving services

“I didn’t want to be in a role where I was buying companies and stripping assets rather than investing in the workforce. It didn’t sit well with me, especially with my lived experience of working several low-wage jobs during high school and college.”

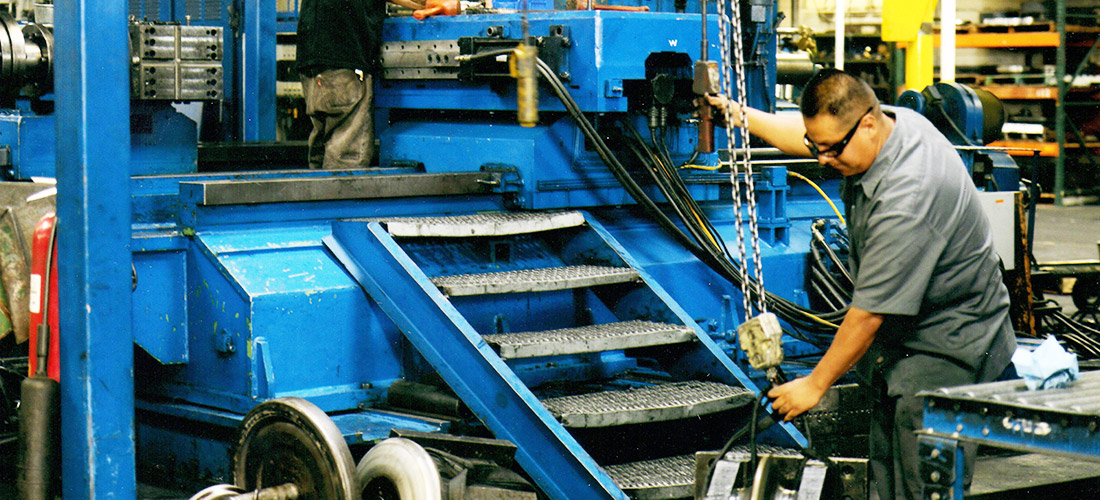

Advanced Structural Alloys, one of many portfolio companies HCAP has invested in to support both financial returns and quality jobs.

“Gainful Jobs Approach [is] an operational framework for understanding job quality standards at our portfolio companies, which are underserved, lower-middle market companies primarily throughout California and the western US.”

HCAP Partners investment team, Bhairvee Shavdia, far left

“In 2017, when I needed paid leave for the birth of my daughter, I discovered HCAP, which was founded in 2000, didn’t have a formalized parental leave policy. They had never needed one.”

“My lived experience makes me sensitive to the challenges facing women—especially women of color. We need to address them.”